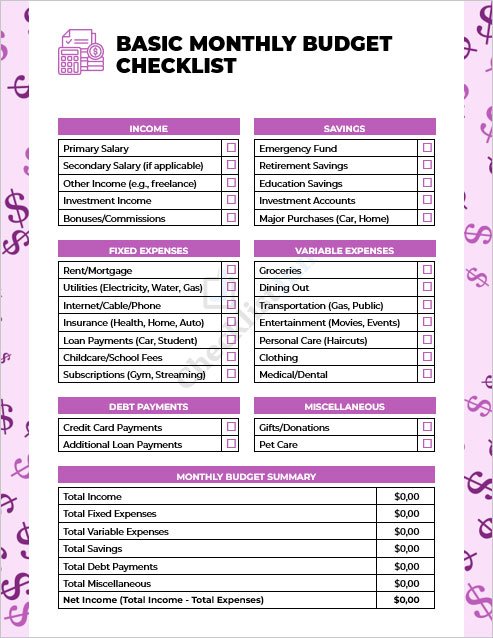

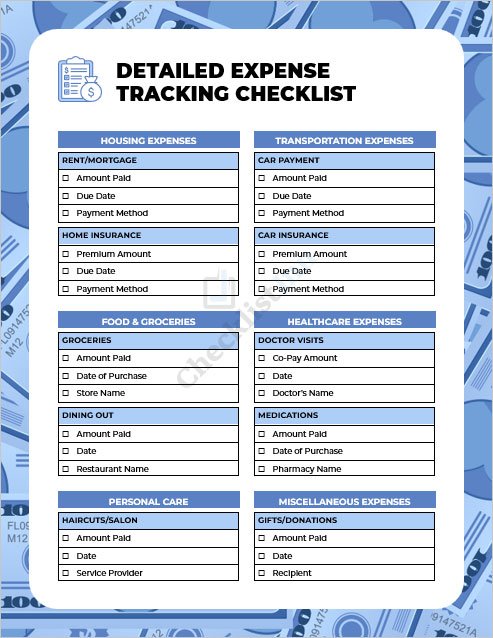

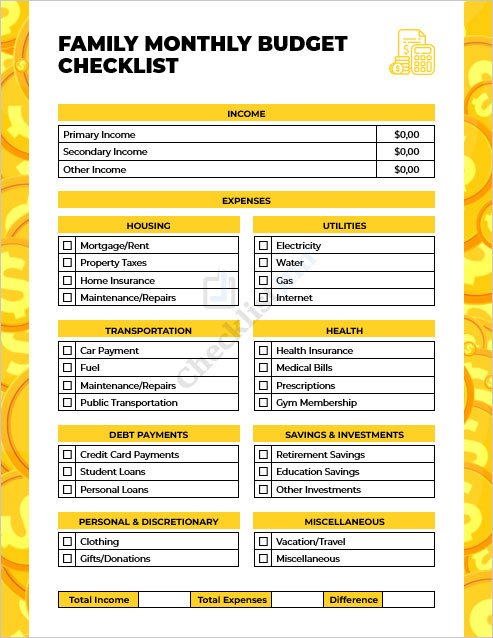

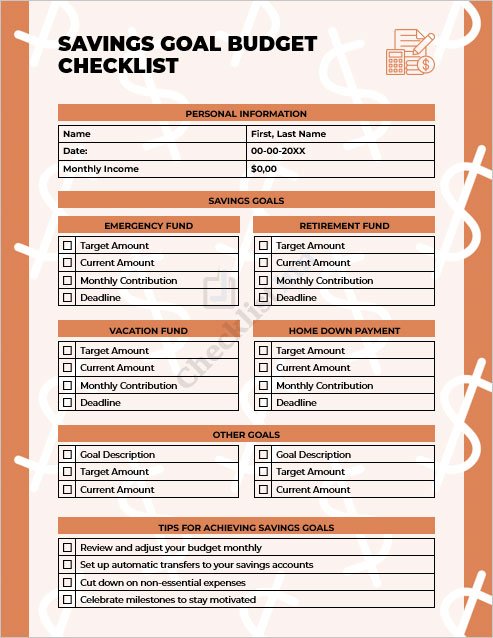

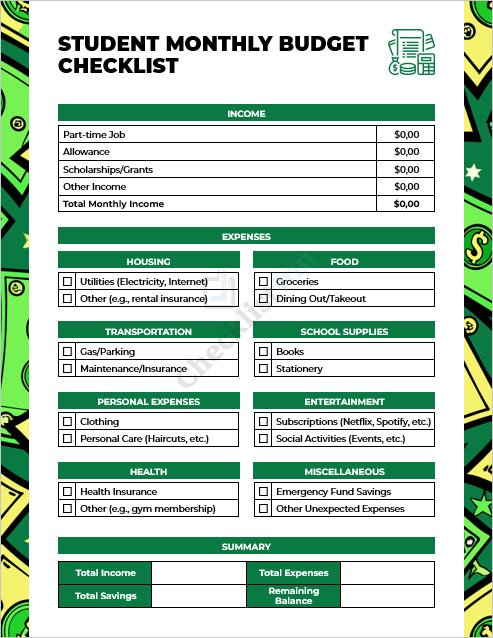

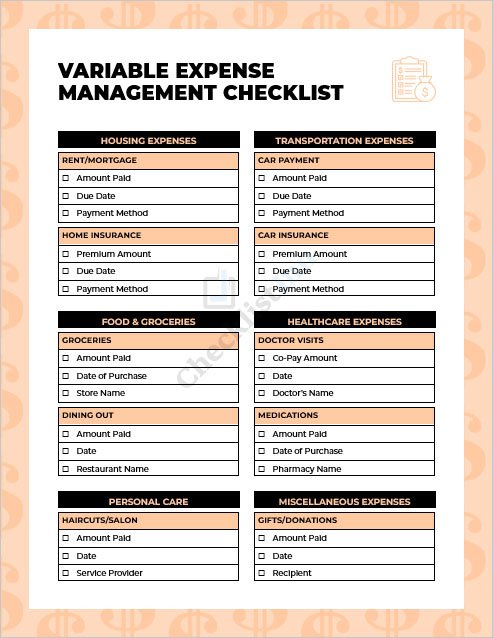

Take control of your money with our free Monthly Budgeting Checklist Templates—simple, customizable tools to track expenses, save more, and stress less.

Getting ready for an international trip is exciting, but it can also feel overwhelming with so many details to manage—documents, health preparations, packing, and budgeting. Forgetting even one essential item can cause stress along the way. To help you stay organized, we’ve created free, easy-to-use travel checklists you can download in Word format. Whether you’re traveling for business, a family holiday, or an adventure abroad, these templates make preparation simple, professional, and stress-free.

Managing money can feel overwhelming, especially when bills, savings goals, and unexpected expenses all pile up. That’s where a monthly budgeting checklist makes life easier. Instead of trying to keep everything in your head, the checklist acts as a simple guide that reminds you of what to track each month.

In short, it gives you a clear picture of your finances so you can make confident, stress-free decisions about your money.

Ready to take control of your finances? Our free, professionally designed Monthly Budgeting Checklists are here to help. Each template is available in MS Word format for easy customization and printing. Click on the links below to download the checklists that best suit your budgeting needs:

Managing money doesn’t have to feel overwhelming. A monthly budgeting checklist gives you a simple step-by-step way to see where your money is going and what you can improve. Instead of leaving things to guesswork, it helps you stay organized and confident about your financial decisions. Here’s how it can make a difference:

In short, using a monthly budgeting checklist isn’t just about numbers—it’s about building habits that give you peace of mind and more freedom with your money.

Keep it simple—just two columns (Plan vs. Actual) is often enough to stay consistent.

A monthly budgeting checklist is a simple tool that helps you track income, expenses, and savings goals so you can manage your money with ease.

A checklist breaks budgeting into clear steps, making it easier to follow, stay consistent, and avoid missing important expenses or payments.

Yes, all templates are fully editable in MS Word, so you can adjust categories, amounts, and goals to match your lifestyle.

Yes, our monthly budgeting checklist templates are 100% free to download and use.

Anyone—from students and families to professionals—can use a budgeting checklist to stay organized, save more, and reduce financial stress.