Take control of your finances with ChecklistInn’s easy-to-use and fully customizable financial planning checklists—your step-by-step guide to saving, investing, and securing your future!

Taking charge of your money is the first step toward reaching your goals. Our financial planning checklist templates are designed to be clear, practical, and easy to use. Each template is fully editable, so you can change it to fit your particular financial goals. These checklists guide you through the steps of organizing your investments, setting up an emergency fund, and saving for retirement. Get your templates right away so you can start planning your financial future with assurance.

Get started with your financial planning by downloading our easy-to-use templates in MS Word format. Each checklist is fully editable, allowing you to tailor it to your specific needs and ensure you stay organized every step of the way.

Financial planning is the process of managing your money wisely so you can achieve both short-term needs and long-term goals. It goes beyond simply saving — it’s about creating a clear strategy that balances income, expenses, savings, investments, insurance, and retirement preparation.

A good financial plan acts like a roadmap for your life. It helps you:

By breaking complex financial decisions into clear, actionable steps, financial planning makes it easier to stay organized, avoid stress, and secure your financial future.

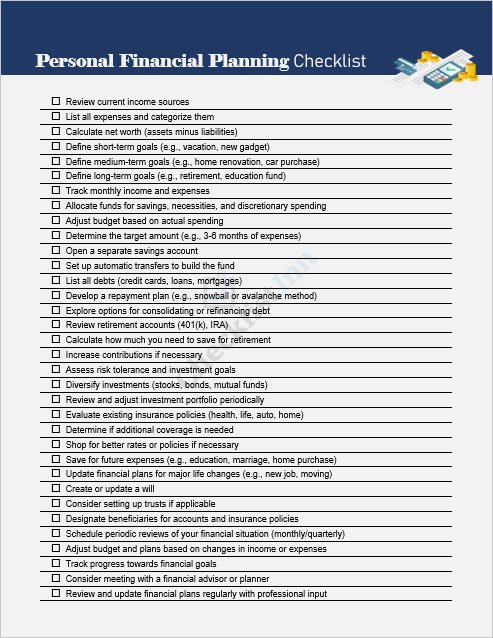

Tailor your financial plan with this customizable template to stay on track with your financial goals.

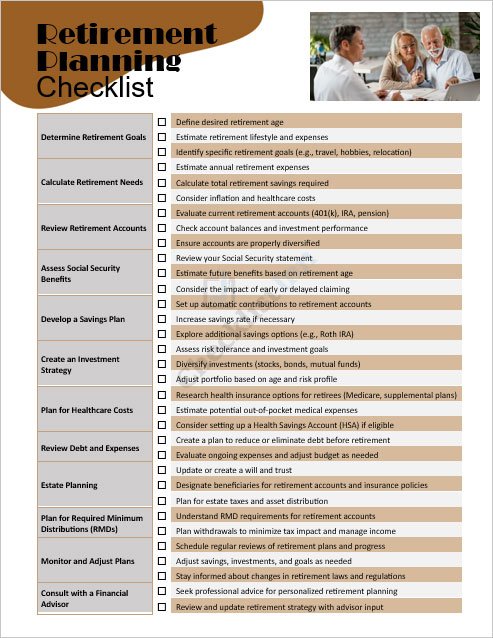

Ensure a secure retirement by covering all key areas with this detailed checklist.

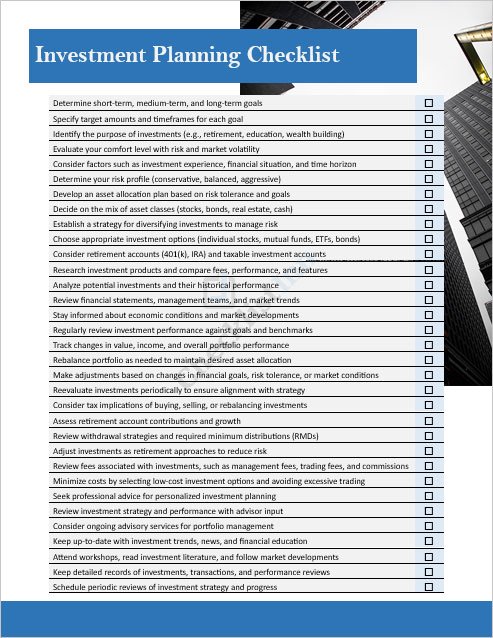

Make informed investment decisions with this comprehensive template.

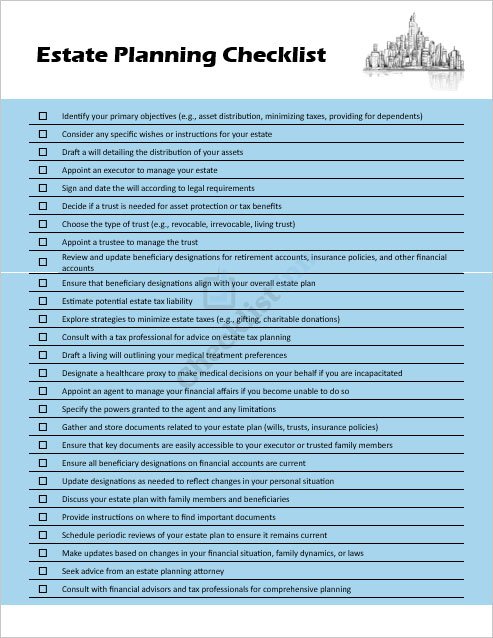

Organize your estate planning process efficiently with this easy-to-follow checklist.

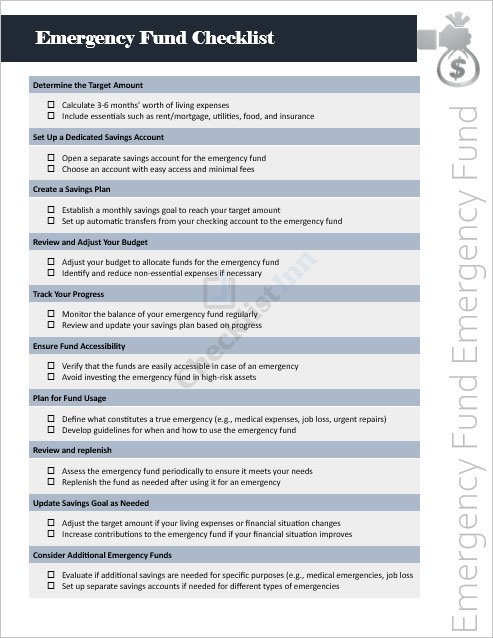

Prepare for unexpected expenses by building a robust emergency fund with this template.

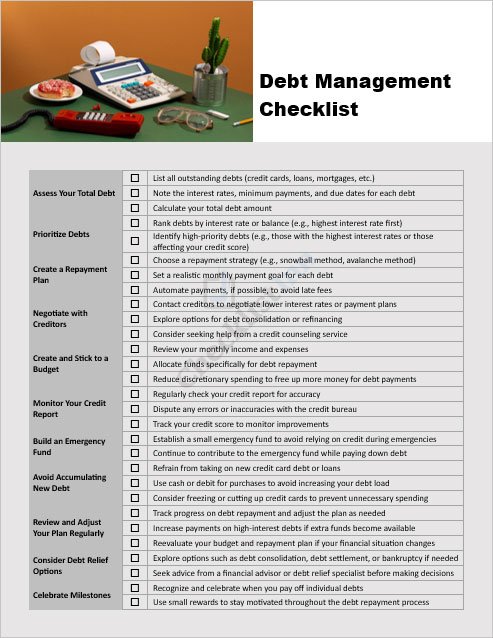

Take control of your debt with a structured approach using this checklist.

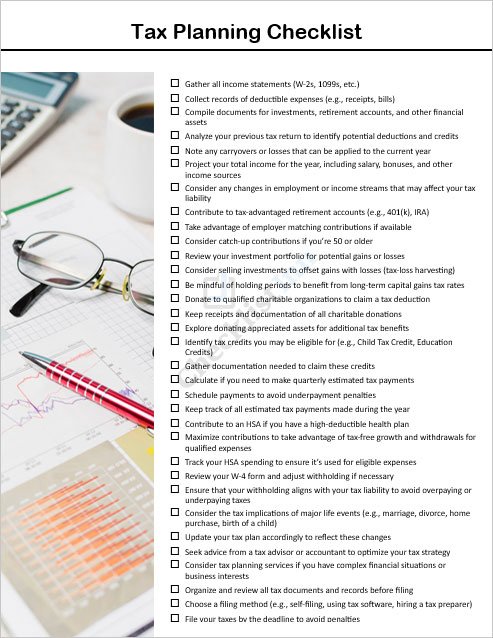

Maximize your tax savings with strategic planning using this essential checklist.

Managing money can feel overwhelming, but a financial planning checklist makes the process a lot simpler. Instead of trying to remember everything on your own, you have a clear guide that walks you through each step. Here’s why these checklists are so helpful:

In simple terms, a financial planning checklist works like a roadmap—it keeps you on track and gives you more confidence as you work toward your goals.

Using these financial planning templates is simple and straightforward. Just follow these steps:

These easy steps ensure your checklist stays useful and helps you stay on top of your financial goals.

Yes! All the templates on this page are free to download in MS Word format.

Absolutely. Each checklist is fully editable, so you can customize it for budgeting, saving, investing, retirement, or any other financial goals.

No. The templates are provided in MS Word format, which means you can open and edit them in Microsoft Word or any compatible word processor.

It’s a good idea to review and update your checklist regularly—at least once every few months or whenever your financial situation changes.