Discover free Credit Score Management Checklist Templates that make it easy to track, repair, and improve your credit—download and take charge of your financial future today.

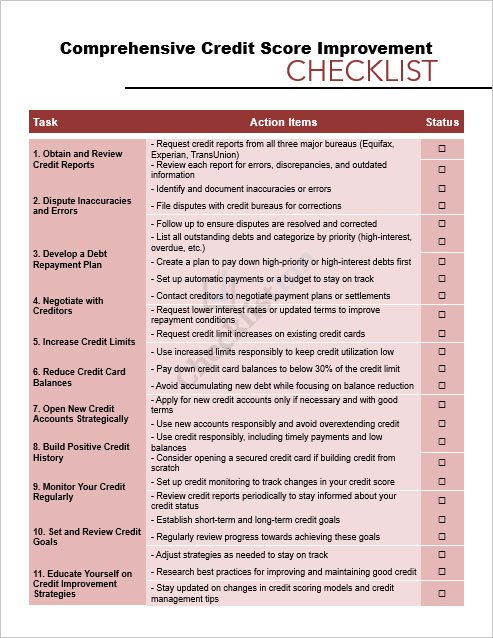

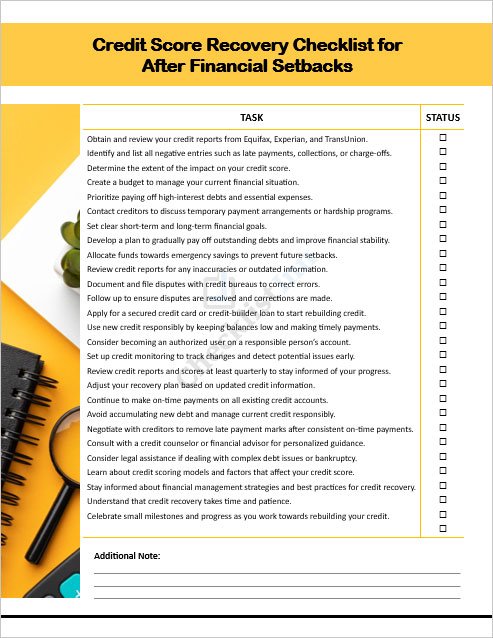

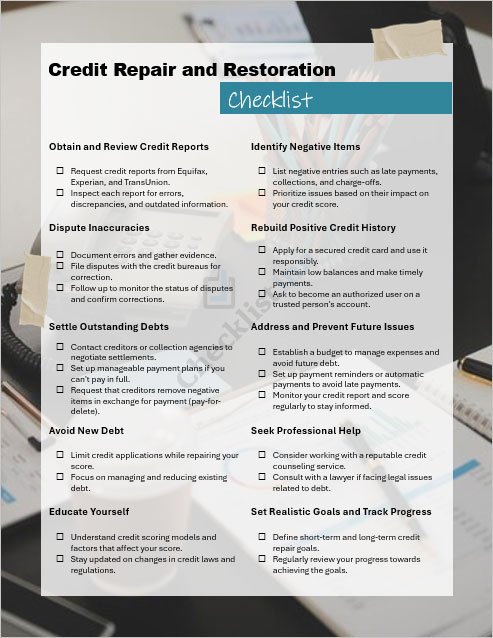

Managing your credit score can feel complicated, but having the right tools makes it much easier. Our free, professional Credit Score Management Checklist Templates are designed to help you track payments, monitor utilization, and stay organized with your financial goals. Whether you’re repairing credit, building it from scratch, or simply maintaining a strong score, these customizable MS Word templates give you a clear step-by-step approach to keep your credit health on the right path.

Your credit score is like a report card for how you handle money and debt. It’s calculated from a mix of factors—whether you pay your bills on time, how much of your available credit you use, how long you’ve been using credit, and even recent checks on your credit history. In simple terms, it shows lenders how responsible you are with borrowing. A higher score tells them you’re a safe bet, which often means easier approvals and lower interest rates. A lower score, on the other hand, can make it harder to get credit or may cost you more in fees and interest.

Ready to take control of your credit score? Our customizable MS Word templates make it easy to manage and improve your credit. Whether you’re looking to monitor your score, recover after a financial setback, or just keep your credit in good shape, these checklists are designed to guide you every step of the way. Download them today and start managing your credit with confidence!

Your credit score impacts more than just loans—it can affect interest rates, rental applications, job opportunities, and even insurance costs. By managing your score, you can:

Taking care of your credit score helps you save money, access more opportunities, and build long-term stability.

Staying on top of your credit doesn’t have to be complicated. Follow these simple practices to protect and improve your score:

Using these templates is simple:

A Credit Score Management Checklist is a simple tool that helps you track key actions—like paying bills on time, monitoring credit reports, and keeping credit utilization low—to maintain or improve your credit score.

Yes! All the Credit Score Management Checklist Templates on this page are completely free to download in MS Word format.

Absolutely. These templates are fully editable, so you can add your personal details, adjust categories, and tailor them to your financial goals.

It’s best to review and update your checklist at least once a month to stay on top of payments, balances, and any changes to your credit score.